During the 2nd EU Fresh Info Forum & Round Table which took place in Rotterdam December 1-2, there was much focus on the role of data in today’s and tomorrow’s horticultural enterprises. This year’s event attracted more than 320 participants and speakers. “The international fresh produce world is represented with participants from 16 different countries, from all six continents,” organisers said. The organisers are all firmly established in the field of information management. Frug-i-Com is a Dutch framework of cooperation in the chain of fruit and vegetables which set itself the ultimate goal of facilitating the electronic exchange of information among participants from the fresh produce sector by means of uniform labelling and electronic messages. They organised the event together with their partners, GS 1 in Europe, who work on harmonised standards and solutions for European business, and IFPS, the International Federation for Produce Standards, which has the objective of improving the efficiency of the fresh produce supply chain through international standards. The overarching title of the gathering, Horticulture 4.0, was chosen to refer to the fourth industrial or digital revolution made possible by the combination of the internet and new technology such as robots and drones. The theme of the conference was that the integration of ICT in the design, production and distribution process of the fresh produce industry is inevitable.

Open data and cultural issues

This digital revolution is not only a thing of the future – it is already happening today. “Without realising we are very much influenced by the internet and data,” said Mario Campolargo, director of the NET Futures European Commission. He thinks that big data and open data are important to digital development and complete ecosystems, including in fields such as logistics, agrifood, e-learning, and media and content, and should be innovated around these open data in order to create new business models. “It’s not just about technology, it is about the ability to develop new business models,” Campolargo said. The sharing of data is not yet a natural thing to all parties involved since it raises concerns about privacy. Campolargo explained that – though a topic the EC is working on – legislation in the area of ICT is very difficult since developments are moving very fast. Legislation is not the only issue surrounding this topic. “There is a big cultural issue about adopting IT solutions,” said Ben Horsbrugh, director of quality management at Univeg – a Belgian based worldwide supplier of fresh produce. “Moving from paper-based processes to data-driven processes is complicated.” It calls for a different approach to the use of the data generated. “You have to change from a batch-by-batch approach to really using your data for improvement,” Horsbrugh said. Starting with simple solutions is helpful in the adopting process. Data from Excel files can be read in more sophisticated ERP systems and can also be used to assess exactly what data is needed. For Horsbrugh, quality is key when it comes to data management. “Data quality should be the sum of the quality improvement strategy,” Horsbrugh said. For the future, he foresees a movement into the direction of using data at the growers’ fields. “But it depends on the sophistication of the process.”

Transparency and chain cooperation

Christoph Waltert, business excellence manager with SanLucar, would even go as far as to say that trade information is a strategic asset. At SanLucar, information management is geared towards creating business excellence. “There are four requirements for information in order to drive excellence,” Waltert said. He mentioned quality, completeness, the real time factor and people, acknowledging that the latter adds complexity to the process. But that’s not to say that improvement cannot be achieved with simple measures as well. “It can be a sophisticated solution but a standardised Excel sheet can do the job as well,” Waltert said. In the end, information management needs to be a continuous and joint effort. “The whole fruit and vegetable sector needs to work on information management and standards, in order to drive business excellence together and individually,” he said. Retailers appear to be focusing on chain cooperation too. “Information sharing is of crucial importance in supply chains,” said Ruud Limmen, vice president of value chain development at Ahold Europe, the group to which Albert Heijn belongs and the Netherlands’ largest retailer. Albert Heijn operates according to the motto Better Every Day. To achieve that, the retailer has a focus on the centralisation of information based on real-time connections with check-outs and suppliers. Jumbo, the Netherlands’ fastest growing grocer, calls for transparency in the fresh supply chain in order to establish consumer trust. “This is particularly important for the 8.000 private label products that Jumbo carries and is responsible for,” said Johan Hulleman quality manager at Jumbo Supermarkets. Data management plays a large role in Jumbo’s supplier management for private label products. A database is built to connect suppliers and other data in order to plot supplier risk in a matrix based on product hazard and supplier impact. In this process the sharing of responsibilities and partnerships with suppliers – particularly where it concerns sharing data – are key to building consumer trust.

Field robotics

The importance of data sharing was also stressed by Professor Salah Sukkarieh from the University of Sydney, who is an international expert in the research, development and commercialisation of field robotic systems. “Farms need to open up and combine data,” he said. In the area of precision agriculture and field robotics, standardisation will become very important and so will the availability of data, too. And there is no doubt that robotics will play a role in the future of farming. “Robots will come, that is a reality,” Sukkarieh said. Robotics in agriculture is all about data collection – to a very specified level; this may even be at the level of individual flowers on a tree- by drones or other specially designed devices. Algorithms are then applied to the collected data and the results can help make a determination about the crop that is analysed. For instance, it is possible for a device to determine whether the plant analysed is a crop or a weed and following that a robotic arm can then spray the plant with either nutrients or a herbicide. This opens up far-reaching opportunities. For instance, selective harvesting could be a possibility. “This is about how you fuse statistical information to build a picture of the total supply chain which will lead to more standardisation of crop architecture,” Sukkarieh said.

All in all, the digital revolution is offering the horticultural sector many developments and plenty of food for thought. What is clear is that open data, chain cooperation and standardisation will be key to this process. Are we headed for a future in which the fresh produce supply chain becomes predictable?

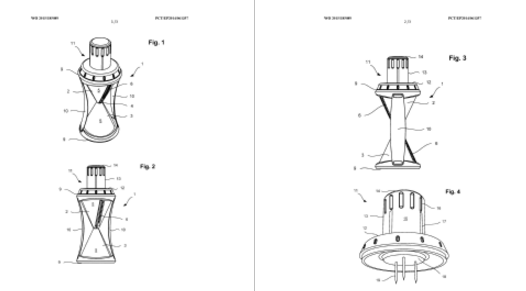

Image: courtesy of Frug-i-Com