Fruit and vegetable trends now and what may lie ahead

Axfood is Sweden’s third largest grocery retailer and also its leading convenience store wholesaler. Here we speak to Daniel Månsson, general manager of fruit and vegetables, about trends in Axfood’s fresh produce sales in what is one of the most affluent nations in Europe and the biggest retail market in Scandinavia.

What changes have you seen in your fresh produce sales?

Some years ago bananas were the biggest but now with the wide assortment of tomatoes, tomato sales have increased. Before there were just the vine tomatoes and the normal big red tomatoes, now there are 20-25 varieties in the tomato segment. On average, fruit and vegetables account for about 11–12º% of our total store turnover.

What trends do you see?

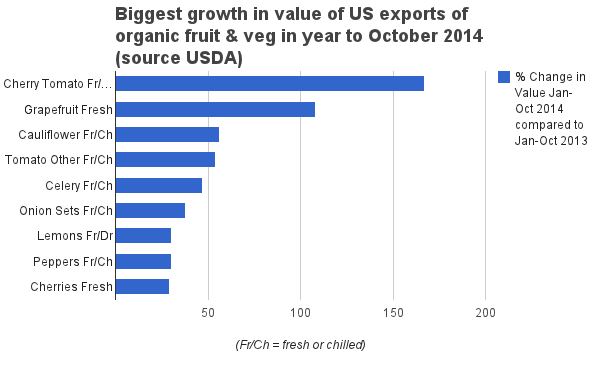

In general in Sweden, the biggest thing that is happening is organic – it’s getting really huge. This year we have an increase of about 100% and, for example for bananas, one of our supermarkets, Hemköp, has decided to stop selling conventional bananas so we have converted almost all of them now but officially next year we will do only organic bananas.

Another big trend is we are selling more premium, higher value products.

And In the last three years, the biggest increase has been in organic and berries, and cherries have also been very good.

What is happening with convenience foods in Sweden?

Convenience food is still not so strong in Sweden. I don’t think people are willing to pay for it, I think that’s the problem.

We are good in lettuce but everything else is just starting up. We have the products but we are not selling them, and it’s the same for our competitors. Part of the problem is volumes are low so the prices are high but even in categories like carrots, where prices are not that high, we sell almost nothing.

Even in ready-to-eat salads the only thing we have is the Caesar – we eat quite a lot of that in Sweden.

Five years from now what do you think will be different in your fruit and vegetable departments?

For sure there will be a big focus on social responsibility and organic products.

I also think we will have more convenience items, especially in salad and even pre-cut fruits. Also, berries will continue to grow – we have a big health trend.

What is changing and why regarding root vegetables?

What we see is more not the big root vegetables, like carrots, but mainly smaller ones like red beets, parsnips, that kind of thing, increasing quite heavily. It’s probably due to a lot of recipes and cooks on TV and also I think it’s for health and good taste reasons. The thing is you just need to know how to cook them.

What change have you made in fresh produce that you are most proud of?

I think we have done a good job in berries. We are happy because I think we are growing more than the market. Price is very important but with berries quality is even more important so we are very focused on it.

We also do a lot of in-store promotions and let people taste the berries and let everyone know they are no longer just for summer, you can now find good berries all year round.

What have you done to maximise the shelf life of berries?

We know the volumes of our clients and have been working a lot together on the turnover in our warehouse. We have a very quick turnover, the berries can’t stay long in our warehouse. And we’ve also done lot of education for the stores.

Where do you see opportunities for suppliers?

What is interesting right now is organic. I think it’s there to stay in Sweden and the increase is huge.

Tell us about your buying process

We started our own buying department in 2007. Before then we had wholesalers doing the business for us. Our supply department is not located in the company headquarters but in Helsingborg in the south of Sweden.

What are the advantages of having your own buying department?

We are always aim to be as close to the grower as possible. We don’t want to have a lot of middle hands. This way we get the right info and we believe we get fresher products. Growers and grower organisations are our main focus.

Axfood:

Store chains:

Hemköp (including Prisxtra): higher end supermarket

180 stores, 69 of them wholly owned

Willys: soft discounter & Axfood’s biggest supermarket

183 stores, of which 48 are Willys Hemma stores

Tempo/Handlar’n: 366 franchise stores

Wholesale

Dagab: 2 full-assortment warehouses, 2 cold storage warehouses

Axfood Närlivs: 3 distribution centres, 20 Snabbgross stores

Sources of Axfood’s fruit & veg (approx., vol.)

Sweden 40% (mostly veg)

Spain 20%

Holland 10%

Top vegetable sales (val)

1 tomatoes

2 lettuce

3 capsicums

Top fruit sales (val)

1 bananas

2 apples

3 berries (over whole year)

Berry sales

Up 300% in 5 years

JB

Click here to read more such articles in our latest edition, number 134