The market for fruit and vegetable ingredients is projected to grow at a CAGR of 6.6% and to exceed $180 billion by 2019, according to a report by market research firm MarketsandMarkets.

And while Europe led the market for fruit and vegetable ingredients in 2013 – due to substantial growth in the processed food and beverage sector – the Asia-Pacific region – especially China and India – is expected to be the fastest-growing market for fruit and vegetable ingredients in the next four years. Fruit and vegetable concentrates, in particular, are enjoying increasing demand there in line with growing consumer interest in healthy beverages.

In the report, ‘Fruit and Vegetable Ingredients Market’, author Nayan also predicts growth of the market in Latin America. She said this will be driven by factors such as greater demand for customised fruit and vegetable ingredients due to increasing consumption of processed dairy and ready–to–eat food products.

Fruit and Vegetable Ingredients Market Size, by Region, 2013 ($Billion)

Source: Industry Journals, Company Publications, Related Publications, and MarketsandMarkets Analysis

How fruit and vegetable ingredients are used in the market

The report categorises the fruit and vegetable ingredients market on the basis of the key type of ingredients – concentrates, pastes and purees, NFC (not from concentrate), and pieces and powders.

It also segments them according to the main end applications – beverages, confectionery products, ready-to-eat products, bakery products, soups and sauces, dairy products, and others (including dips, spreads, dressings, toppings, and puddings).

The ready-meals industry is a big user of canned vegetables (mainly for pizzas, pastas, soups and fresh and frozen meals), as is the meal components sector, while baby food companies use a variety of preserved fruit and vegetables.

An application experiencing growth is the use of fruit and vegetable-based ingredients as colouring and flavouring agents in foods and beverages, in response to consumer concern over synthetic ingredients.

Key players analysed in the report

Among leading market players profiled are the Archer Daniels Midland Company (US), Kerry Group plc (Ireland), AGRANA Group (Austria), DohlerGroup (Germany), SunOpta, Inc. (Canada), and SVZ International B.V. (The Netherlands).

Other prominent companies in the market are DIANA S.A.S. (France), Olam International Limited (Singapore), Sensient Technologies Corporation (US), and SensoryEffects Ingredient Solutions (US).

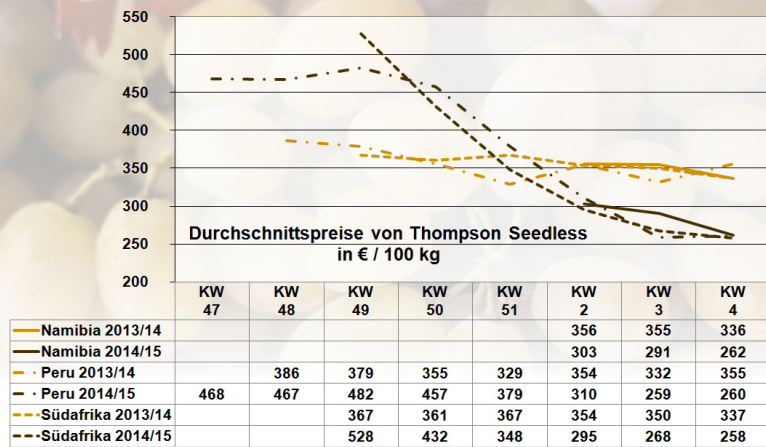

Seasonal shortages, price fluctuations limiting growth

Nayan says government initiatives to promote the fruit and vegetable ingredients industry and increasing trade in these commodities have complemented the overall growth of this industry. “However, strict food safety legislation and seasonal variations affecting the supply of raw materials with fluctuating prices restrain the growth of the market.”

Fruit and Vegetable Ingredients Market Size Trend, 2012–2019 ($Billion)

E – Estimated; P – Projected

Source: Industry Journals, Related Publications, Company Publications, and MarketsandMarkets Analysis

Read more about the ‘Fruit and Vegetable Ingredients Market’ report.

MarketsandMarkets advises that readers can avail of a discount of up to 30% on the off shelf report by using the code FAPRI30 in the “specific interest” section of the contact page of its website.

Image courtesy of Wikimedia Commons.