US retail favours innovative greenhouse tomatoes

The US fresh tomato market is a mature one which has seen a shift in product types and hunger for heated greenhouse crops.

After decades on the rise, US fresh tomato consumption seems to have stabilised in recent years. From an average annual per capita consumption of just under 7 kg in 1990, fresh tomato consumption rose to 9.5 kg in 2010 and has remained stable ever since, according to the USDA/ERS vegetables and pulses yearbook, 2015.

The US average annual per capita fresh tomato consumption is in line with European consumption, which also stands at 9.5 kg. However a remarkable difference is that European consumption has fallen from 12 kg since 2004, whereas in the US it has more or less remained stable since then.

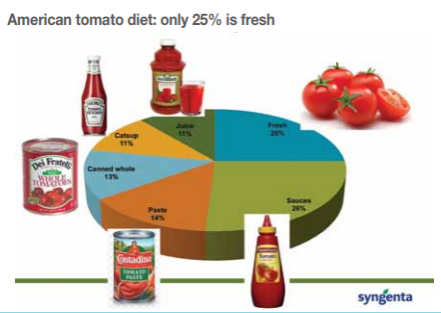

Fresh tomatoes account for 25% of US tomato consumption. The remaining 75% is consumed in the form of tomato juice, sauces or canned tomatoes. While only accounting for a small portion of the tomato market – although with the current population of 322 million people expected to grow to 373.5 million by 2030 that is relative – it is specifically the fresh tomato market that is on the move.

Only 41% self-sufficiency

The domestic tomato crop meets just 41% of demand in the US. A small proportion – 6% – is imported from Canada but the vast majority of fresh tomatoes for this market are supplied by Mexican growers who offer consistent winter supplies and low labour costs and account for 52% of the market, information from Syngenta shows.

In both domestic production and imports, demand is shifting towards tomatoes grown in heated greenhouses, Syngenta portfolio marketing manager EMEA Andrea Launeck, said during the ‘Tomatoes, trends towards 2020’ conference in Antwerp in April.

The open field green harvest appears to be under pressure and the open field ripe vine and local plastic greenhouse productions are losing power in the retail market. Heated greenhouses focus on the supermarkets and appeal to them with an offer that is innovative, has a stable production volume and is able to limit its labour requirements.

Launeck has observed a shift in the market from beef and cluster (UK truss) tomatoes towards snack tomatoes and flavour. Again, the greenhouses seem to be able to address those needs better than the open field growers.

The impressive growth in the covered production of tomatoes that Mexico has achieved is a good example of that. Since 2005 their surface area has almost tripled.

According to Syngenta, in 2005 the covered production area of tomatoes in Mexico was 3,300 ha; in 2015 it had grown to 12-15,000 ha. About 80% of the investment in covered tomato crops focuses on exports to the US, Launeck said.

Half the volume comes from field crops

Although it is decreasing, open field production still accounts for the majority of the US tomato crop. About 50% of the tomato volume is destined for food services and is mainly open field, with beef tomatoes and a short growing cycle for green harvesting playing an important role. This mainly takes place in California and Florida, as well as in imports from Mexico.

The open field production of large sized tomatoes accounts for another 25% of the total volume, focuses on local production for local consumption and is sold to grocery stores. These are usually small operations all across the US.

The remaining 25% of tomatoes, including both US production and imports from Mexico and Canada, are grown in heated greenhouses with a focus on the retail trade, which offer innovative tomatoes addressing customer values, packed under own brands, and providing retailers with reliable year-round supplies.

»Presentation by Andrea Launeck of Syngenta

This article was originally published on page 46 of edition 145 (Sep-Oct 2016) of Eurofresh Distribution magazine. Read more fresh produce industry news from that issue online here: www.eurofresh-distribution.com/magazine/145-2016-sepoct