US imports of fruits and vegetables continue to rise

The main US suppliers of fruits and vegetables in 2021 were Mexico (fruit: $8.7 billion and vegetables: $7.49 billion), Canada (fruit: $458 million and vegetables: $1.98 billion), Peru (fruit: $1.76 billion and vegetables: $360.3 million), Chile (fruit: $1.95 billion and vegetables: $2.35 million), Guatemala (fruit: $1.28 billion and vegetables: $197.2 million), and Costa Rica (fruit: $1.7 billion and vegetables: $74.15 million).

Fruit imports up 17% in 2022

The value of US imports of fruit lurched ahead by 17% in the year ending April 2022 compared with the same period a year ago, totalling $18.72 billion, according to recent trade data. By commodity, the main US imports of fresh fruit in that period (with the percent change from a year ago) were berries (excluding strawberries), $4.05 billion, +19%; avocados, $3.32 billion, +35%; bananas/plantains, $2.45 billion, +1%; grapes, $2.04 billion, +16%; citrus, $1.84 billion, +25%; strawberries, $1.4 billion, +8%; pineapples, $803 million, +12%; and mangoes, $734.9 million, +7%.

Regarding fresh vegetables, imports totalled $10.81 billion for the 12-month period ending in April 2022, up 4.9% from the same period in 2021. By commodity (with percent change from a year ago), the main US vegetable imports were tomatoes, $2.7 billion, -2%; peppers, $1.91 billion, +2%; cucumbers, $1.03 billion, +13%; asparagus, $659.9 million, -2%; onions, lettuce, cauliflower and broccoli, and squash.

How US consumers are feeling, shopping and spending

According to McKinsey & Company, the latest Consumer Pulse survey shows that, across the US, people have simultaneously embraced new behaviours and reverted to old ones.

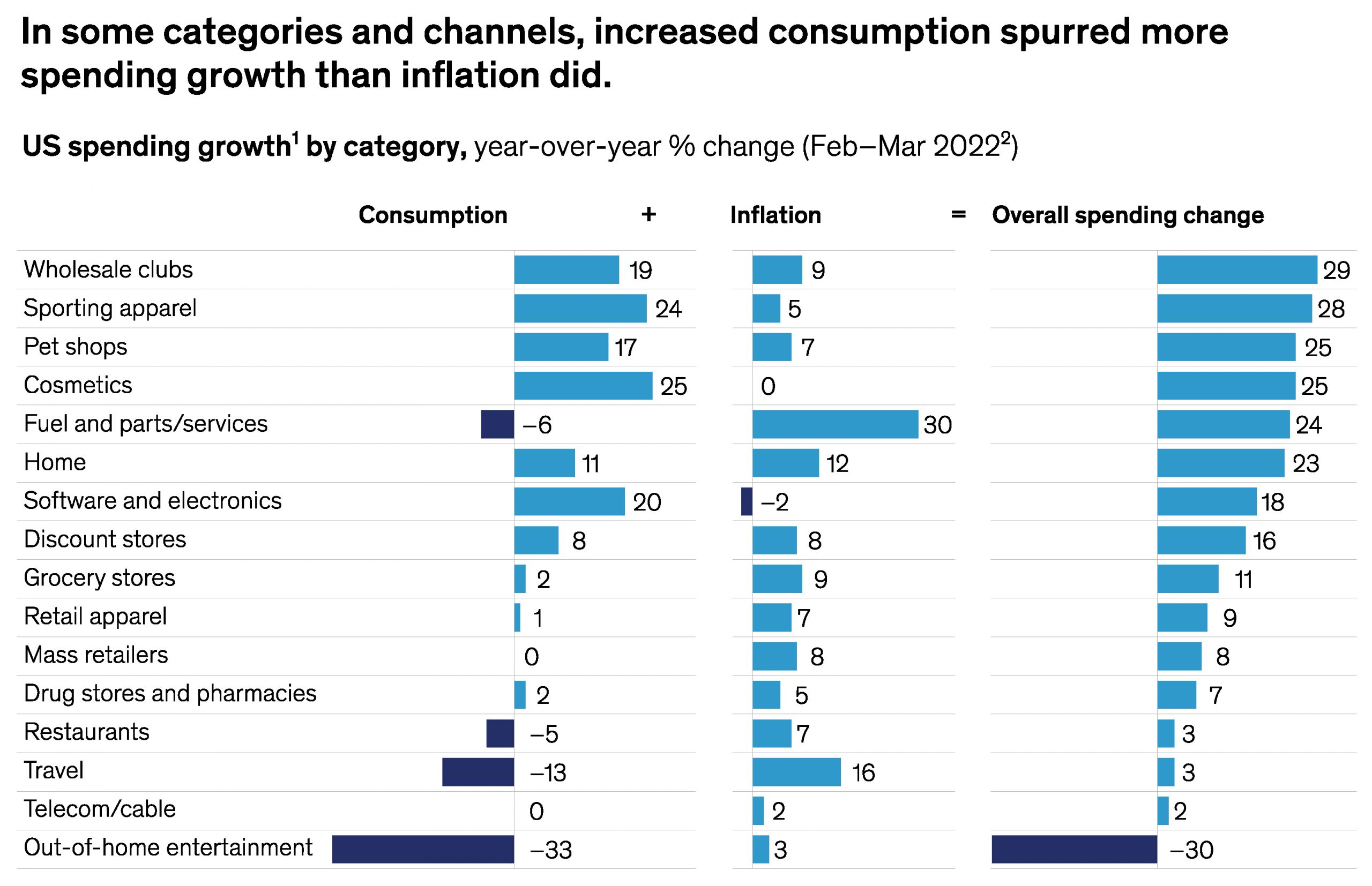

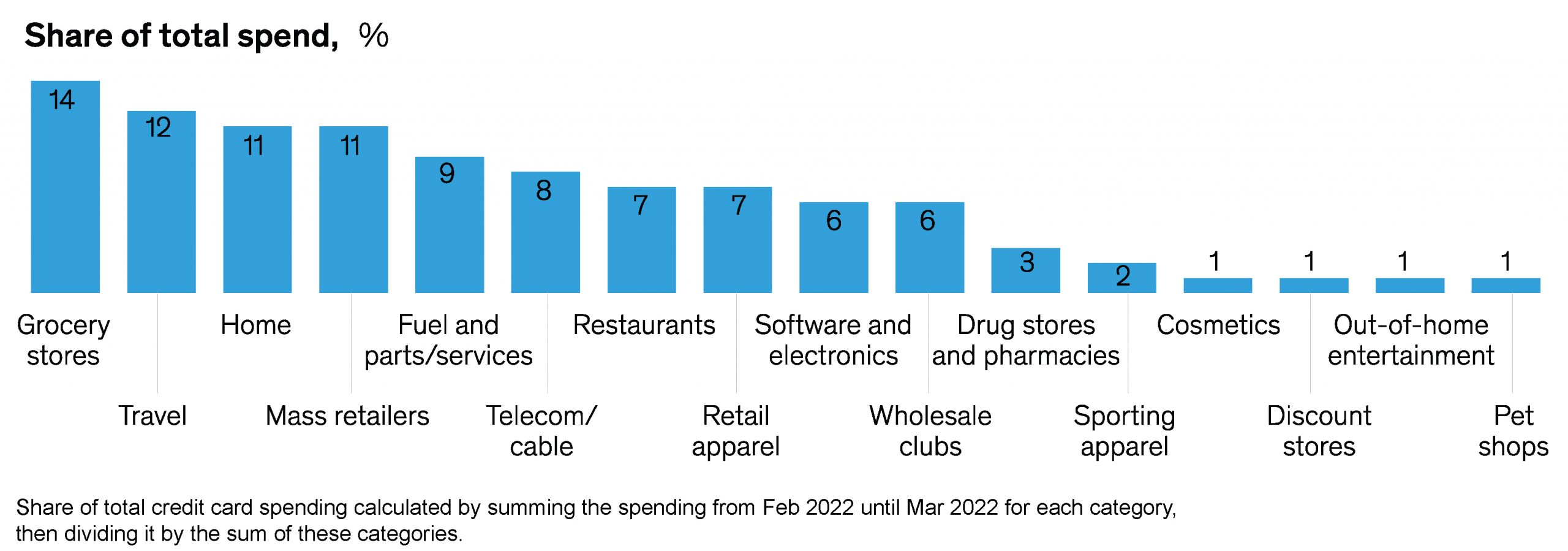

- Inflation hasn’t stopped consumers from spending. Inflation grew to nearly 8.5% in March 2022. Yet, US consumers spent 18% more in March 2022 than they did two years earlier.

- Consumers continue to spend more on certain product categories, but inflation is slowing volume growth.

- The “loyalty shake-up” continues. More US consumers reported switching to different brands and retailers in 2022 than at any time since the beginning of the pandemic. With inflation at a record high, more people are looking for value; price is at the top of the list of consumers’ motivations for switching.

- Shoppers are spending more both online and in stores. The total increase in e-commerce penetration from the onset of Covid-19 until March 2022 was 33%. In store spending is recovering at a high clip. Companies would do well to differentiate the service and experience of in-person shopping while giving consumers reasons to continue to visit their websites and apps.

- Omnichannel shopping is becoming the norm. This behaviour isn’t confined to a few types of products: consumers are doing it for both food and non-food purchases across a broad range of categories. What’s more, 45% of consumers say social media is influencing their purchases.

- Even as people go out again, their “nesting” continues.

- Consumers say they care about ESG, but it means different things to different people. More than two-thirds of younger survey respondents said at least one aspect of ESG is very important to them. In general, they prioritise authenticity and social issues such as diversity, equity, and inclusion, whereas older consumers pay more attention to health and environmental issues.