Uncertain times for Spain’s fresh produce sector

Uncertainty and inflation are the two buzzwords on the lips of Spain’s fresh produce sector, as the boom in fruit and vegetable consumption experienced during the pandemic appears to be over. After household spending on fresh produce reached record levels in 2020, sales dropped in 2021. According to data from the Food Consumption Report of the Ministry of Agriculture, Fishing and Food, the total volume consumed by Spanish households in 2021 was down 8.7% YoY to 7.88 million tons, with the value falling by 8.8% to €13.3 billion. Nevertheless, spending in 2021 was still 1.8% higher than the (pre-Covid) 2019 level. This negative trend continued during the first four months of 2022, as NielsenQ data highlights.

Fruit consumption in 2021 totalled 4.25 million tons, 7.8% less than in 2020, for a value of €7.25 billion (-8%), while vegetable consumption totalled 2.68 million tons (-9%), for a value of €5.2 billion (-9%), and potato consumption stood at 0.95 million tons (-11%), for a value of €844 million (-12%). But fresh fruits and vegetables continued to represent the largest share of households’ food consumption in 2021, with 26.7% of the total volume and 17.8% of the value. Fresh fruits accounted for 14.4% of the total shopping basket in volume terms and 9.7% of the value, fresh vegetables accounted for 9.1% of the volume and 7% of the value, and fresh potatoes accounted for 3.2% of the volume and 1.1% of the value.

Spaniards switching to cheaper produce

Soaring food inflation is driving Spaniards to change their consumption habits. Fruit prices in April were 10.3% higher than a year previously, with watermelons costing 18.7% more than in 2021. According to a survey by the Organisation of Consumers and Users (OCU), the current rise in food prices is the highest in 28 years, prompting 62% of consumers to modify their purchasing habits in line with their reduced disposable incomes. One in five respondents report having stopped buying certain fruits and vegetables altogether.

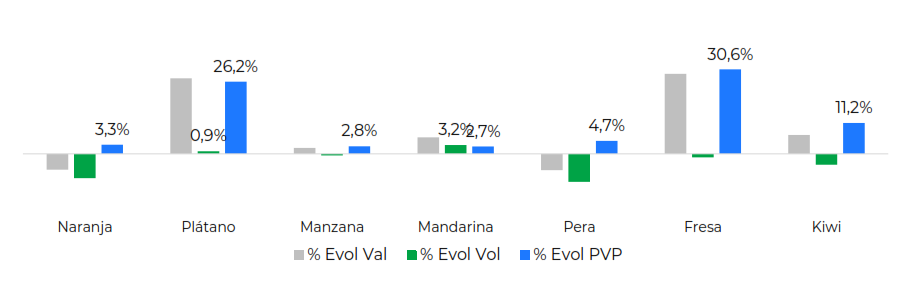

Speaking at the AECOC congress in Valencia in June, Ignacio Biedma of NielsenIQ said there has been a switch to different families of fruit, with consumers substituting expensive seasonal produce, such as watermelon and peaches, with cheaper unseasonal produce such as bananas and apples. Data shows there was a 4.3% drop overall in the volume of fruit sold for the first four months of 2022 compared to a year previously, but the higher prices meant the sales value was up by 6.4%. While demand for bananas, apples and kiwis increased compared to the same period in 2021, demand for oranges and pears fell.

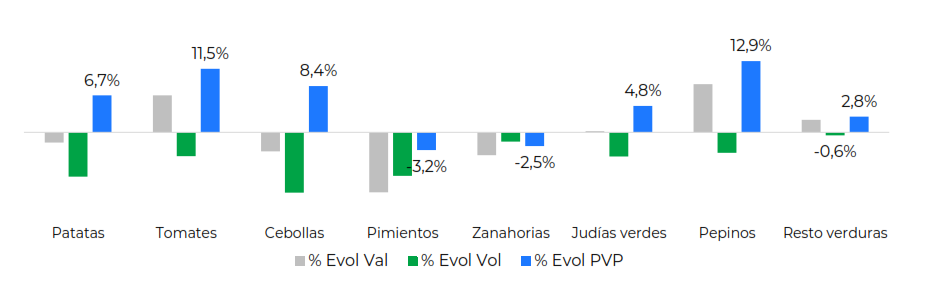

As for vegetables, tomatoes (+11.5%) and cucumbers (12.9%) saw the highest price rises in the first four months of 2022. Demand fell for all categories, with potatoes, onions, peppers and tomatoes the most hit. But despite the price hikes, farmers’ spiralling costs are still not being covered. Consentio CEO Benoit Vendevivere said farmers have seen production costs jump up 9.2% in the past six years, while achieving an increase of only 3.97% in prices received for their products.

Meanwhile, online sales of fresh produce are growing once again. The channel had contracted slightly in 2021 following the relaxing of measures to combat the pandemic, but in the first four months of 2022, it was worth €2.7 million/week on average, compared to €2.5 million/week a year earlier. Canary Island bananas and carrots are the most frequently purchased items.