The big trends shaping grocery in Europe

Five key themes are forecast to mark European grocery retail in what remains of this year and beyond, the first of which is falling sales volumes and rising inflation. Also predicted is greater polarisation, combined with higher price sensitivity and more focus on health, premium, and sustainability. A third trend to expect is slower online growth with more differentiated offers. And two more key trends will be the search for new profit pools; and a shift to new workforce talent models, says the McKinsey & Co. and EuroCommerce report “Navigating the market headwinds – The State of Grocery Retail 2021: Europe”.

A need to boost quality in private label entry tiers

There was pessimism in Europe’s grocery market going into 2022, mainly due to the shrinking spend on grocery retail as restaurants reopened in many parts of Europe, increased price sensitivity and competition (including from a maturing online market), and rising inflation. Wage increases, labour shortages and supply chain issues were further factors. A survey of European grocery CEOs between December 2021 and January 2022 (before the crisis in Ukraine, which has exacerbated the negative trends), found 60% expected the grocery market to become worse this year than it was in 2021, 23% predicted it would remain the same, and 17% that it would improve. The report says inflation has two main implications for retailers – it increases their costs and shrinks consumers’ available income. When inflation is high, consumers tend to downtrade to cheaper items and actively search for promotions. In such a scenario, discounters and players with competitive entry-level private-label offerings are best placed to serve these changed consumer needs, the report says.

Shoppers will increasingly split their spend across more than one online food player.

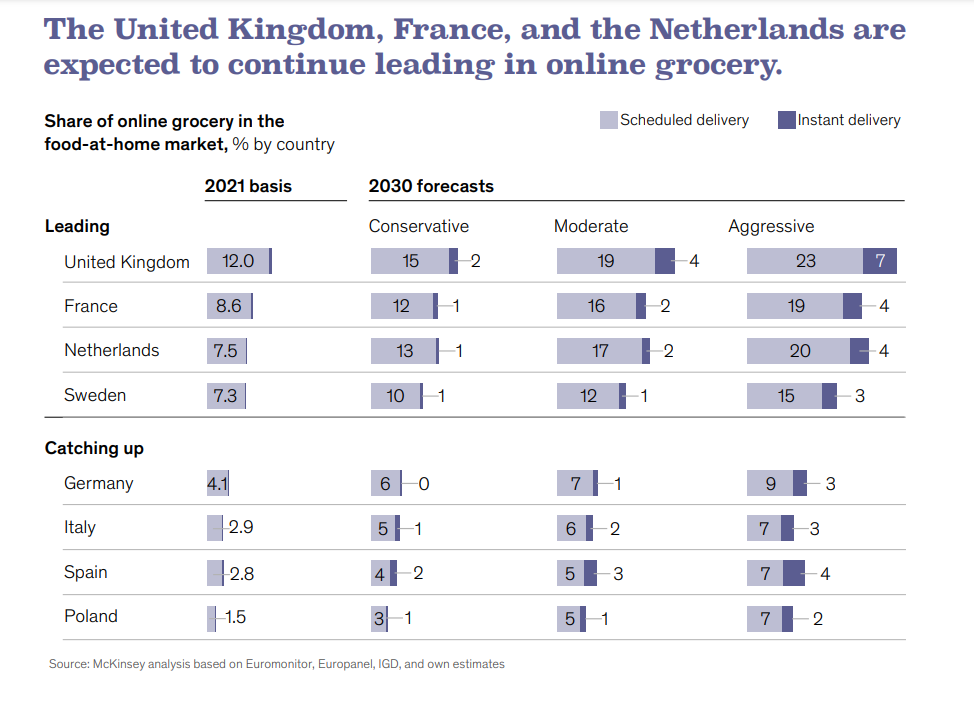

Slower online growth, more differentiated services

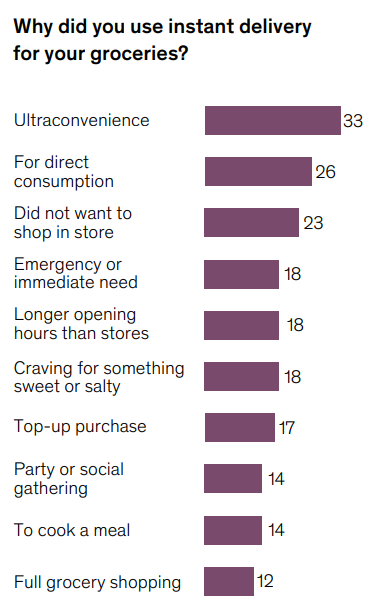

Online growth might pause in 2022 in many markets but is then forecast to resume and by 2030 to account for over a fifth of grocery sales, including up to 30% of the food-at-home market in some leading European countries. However, shoppers will increasingly split their spend across more than one online food player as online offerings become more differentiated. The report envisions the online grocery market basically mirroring existing offline models. The online equivalent for supermarkets will be players with full-basket offerings, such as Ocado, Rohlik and Tesco, which typically have a very large assortment and same-day service, as well farm-to-table concepts (such as Crisp and Frischepost) and meal kit options. Instant delivery is online’s convenience store and small supermarket, with players like Flink, Getir, and Gorillas catering to small basket orders, especially top-ups and unplanned needs, from more concentrated assortments and competing on speed and user experience. Then there’s the equivalent of discounters online, with no-frills assortments from companies (such as Picnic) which offer low-minimum-order values and no delivery fees while emphasising value for money.

“With online pure players disrupting markets, traditional grocery retailers should now determine which value propositions to focus on, define a scalable operating model, and consider partnerships to complement their historic strengths,” the report says.

Opportunities lie in sustainability, personalisation

Consumers, investors and regulators are pressuring food companies to do more on sustainability, and retailers can benefit from this necessary transition, “because sustainability can go hand in hand with value creation,” the report says. Evidence of opportunities is that the sales growth of the 10 brands most bought by eco-friendly customers last year outperformed the market overall by 15 percentage points (Europanel). To succeed in this area, grocers should focus on the five dimensions of health, the environment, the economy, animal welfare, and livelihoods (HE2AL), while identifying opportunities to credibly differentiate themselves and create competitive advantages.

“Grocers can … create significant additional value, but this is a multiyear challenge requiring leadership and focus throughout the organisation, as well as investments,” the report stresses.

Sustainability efforts should be anchored by the CEO and board, who should model a green culture. With divergent demands from low- and high-income consumers, it will also be vital for retailers to better tailor their offerings to these different needs – such as by rebalancing price tiers, building up private labels, making assortment and prices more store-specific, and personalising promotions.

“Retailers will also likely benefit from exploring new revenue sources (such as retail media networks) by monetising their traffic and data,” it says.