State of the Cold Chain Network in China

Being confined to their own home by COVID-19, Chinese consumers resort to the internet for their daily fresh produce. Insiders believe that after the outbreak, shopping online for fresh food may become a new buying habit in China. So it’s about time to look into China’s fresh logistics market.

China’s cold chain logistics market is big. It was worth RMB 295.6 billion (US$41.9 billion) in 2018, showing a growth of 18.8 percent from the previous year – around half of the value of the North American cold chain logistics market (US$81.2 billion in 2018), according to Statista.

However, the construction of cold storage facilities in China is still somewhat backward. In 2018, the per capita refrigerated warehousing capacity of China’s urban residents was only 0.156 cubic meters, far lower than the 0.5 cubic meters per capita capacity in developed countries.

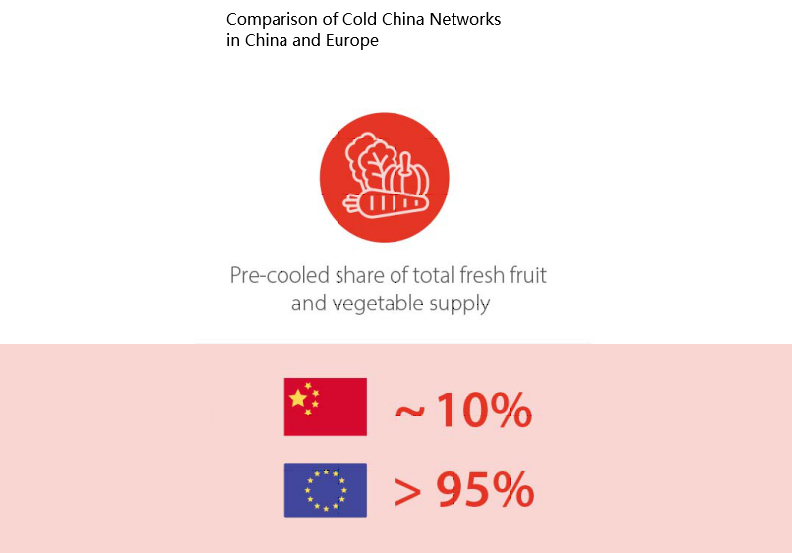

According to Zhou Yuan, a researcher at the Chinese Academy of Sciences, the proportion of pre-cooled fruit and vegetable market share in China is around 10 percent, while in developed European countries and in the US, the share can be as high as 95 to 100 percent.

Limited by the low-level development of cold chain networks, the annual loss of fruit and vegetables alone amounts to hundreds of billions of RMB. Consequently, Chinese governments have been rolling out policies to boost the construction of the country’s cold chain network in recent years.

To seize more market share, leading Cold Chain brands like Baier, Guangruina have also attended Fruit Expo & World Fruit Industry Conference. Covering the whole fruit industry chain including Fresh Fruit, Fruit Processing Equipment & Technology, Cold Chain & Logistics, Fruit Growing & Post-harvest Handling, Fresh Retail, and etc, Fruit Expo 2020 will be an excellent gateway to China’s fruit market. For more details, please check it on www.fruit-expo.com for more update!