Global orange production falls 6 million tons in 2017/18 due to problems in US and Brazil

Global orange production for 2017/18 is forecast to fall 6 million tons from the previous year to 47.8 million as unfavourable weather leads to smaller crops in Brazil and the US. Similarly, fruit for processing is expected to fall, with orange juice production forecast down nearly 25% to 1.6 million tons due to the lower production in Brazil and the United States. Fresh exports are relatively unchanged.

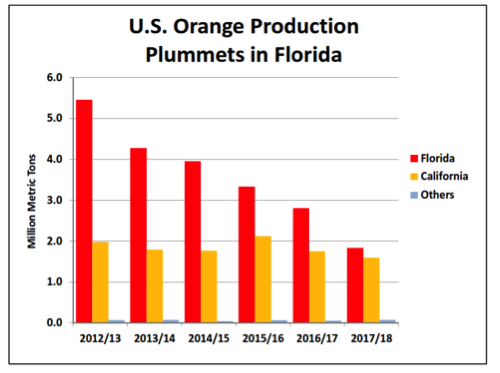

US orange production is estimated to fall 24% to 3.5 million tons due to unfavourable weather and citrus greening disease continuing to cause fruit to drop in Florida before it is ripe. This has led to lower volumes of exports, consumption, and fruit for processing.

Brazil’s production is forecast to fall by 23% to 16 million tons as adverse weather resulted in poor bloom and fruit set. Fresh orange consumption is up 173,000 tons, while oranges for processing are down 5 million tons to 11.1 million. With the drop in oranges for processing, orange juice production is forecast to fall to 1 million tons.

Production in the EU is estimated down 5% to 6.4 million tons, due to lower production area and drought conditions. Imports (which are more than triple exports) are up 10% while oranges for processing and fresh consumption are both down due to lower supplies.

Egypt’s production is estimated to hit a record 3.2 million tons, up 6% from last year due to higher area. Exports are up 5% to a record 1.6 million tons. Egypt accounts for one-third of global orange exports.

South Africa’s production is expected to rise 8% to 1.5 million tons. Exports are forecast to reach a record 1.2 million tons and account for 25% of global trade. The EU remains the top market accounting for over 40% of South African orange exports.

Production in Turkey is forecast at a record 1.9 million tons due to favourable weather. Exports are also at a record high thanks to greater available supplies and high demand in Iraq and Russia.

Morocco’s production is forecast only slightly lower at 1 million tons, with favourable weather following early season drought. Exports and consumption are also forecast relatively flat.

China’s production is projected up 300,000 tons to 7.3 million as a result of clement weather. Consumption is up due to higher domestic supplies and robust import demand for high-quality and counter-seasonal fruit. South Africa and Egypt are the top two suppliers, accounting for 60% of imports.