‘En route’ to better logistics visibility

The global reefer trade expanded 3% in 2021 to reach 290 million tons, of which 48% was seaborne, Drewry estimates. For the seaborne perishables sector specifically, the volume was up 2.3% on 2020 to about 138 million tons, the maritime research consultancy says. The volume of bananas, the 2nd largest seaborne commodity group, shrank 5%, while meat, which ranks first, with 23% of all seaborne reefer trade, nudged its volume up 1.5% despite less imports by China. Though fresh vegetables make up the largest commodity group in the global reefer trade, just 28% of it is moved by sea, compared to 80% for bananas.

Higher freight rates and other challenges

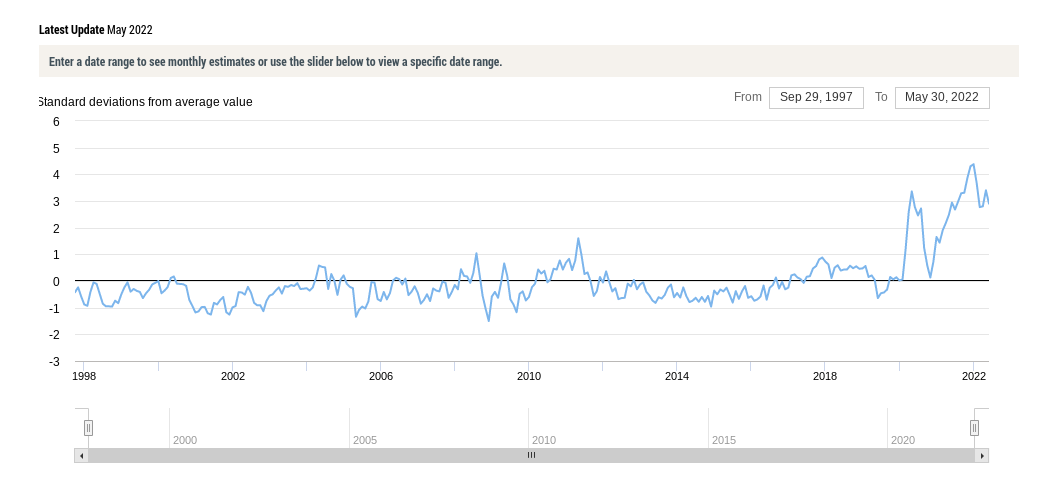

Drewry forecasts a compound annual growth rate of 3.7% to 2025 across all commodities in the seaborne reefer trade, with a CAGR of 4.4% for containerised reefer traffic. In a webinar in February on its Reefer Shipping Market Outlook, it said containers took 88% of global reefer trade in 2021, with the remainder shared by specialised reefers and some fruit juice tankers. “By 2025, over 91% of all cargo will be containerised as investment in specialised reefers trickles to a halt amid uncertainty on future fuel alternatives and container supply chain domination,” it said. In the first quarter of 2022, reefer freight rates were continuing their upward trend (playing catch-up with dry cargo rates), with the Drewry global reefer container freight index 50% above Q1 2021 and double Q1 of 2020. Carriers are avoiding certain cargoes, particularly fresh produce, that involve destinations seen as “too ‘exotic’ and with too many transshipments”, and the traditional reefer imbalance has become worse than ever for shippers in the Southern Hemisphere.

Once critical mass is reached in smart device installs, the next step for shipping lines will be to focus on supply chain visibility service offerings, Drewry says.

‘Smart’ container fleet to expand 8-fold in next 5 years

Smart containers have gained prominence due to Covid-19 and the resultant supply chain disruption, which has highlighted the need for better cargo visibility to cope with longer and more volatile transit times. And the pace of adoption of smart containers is accelerating, Drewry also says. ‘Smart’ containers are those fitted with a telematics device providing real-time tracking and monitoring. Drewry estimates that by the end of 2021, just 3.6% of the whole global container equipment fleet was fitted with smart technology devices, but as much as a third in the case of the maritime reefer container fleet. It expects that in the next 5 years, the number of smart containers will grow to 25% of worldwide box inventories. Once critical mass is reached in smart device installs, the next step for shipping lines will be to focus on supply chain visibility service offerings, Drewry says.

Blockchain can reduce bottlenecks, bother

Also on the topics of transparency and efficiency, the Port of Rotterdam says digital solutions are already fostering more trust, transparency and greater efficiency in the logistics chain. In a recent white paper titled “Data Insight Increases Speed and Reliability in Agrofood Logistics”, Erik van de Kamp, Business Manager Digitalisation at Port of Rotterdam, says digitalisation also paves the way for exchanging more product information including with consumers. “Smart containers can collect all kinds of data during transport, which is useful for all parties in the agrofood supply chain and can be used to optimise processes even further.” The paper says Portbase and Naviporta are only two examples of how digitalisation can make the agrofood supply chain more agile by sharing data neutrally and decentrally. Naviporta is an open platform using blockchain technology to allow users to verify and share documents quickly and easily, while Portbase, with over 5,500 clients and tens of thousands of users, is now the largest Port Community System in Europe and has automated and digitalised more than 30 sub-processes. Naviporta’s Quay Connect solution simplifies customs procedures from the Netherlands to the UK.

Growing push for shipping to be more respectful of sea

In late June, Green Marine Europe (GME), the environmental certification for European maritime transport, published its annual performance report, welcoming the fact that French-based CMA CGM, one of the world’s largest container lines, is now among the programme’s 13 certified ship owners representing a fleet of 323 vessels. It also highlighted CMA CGM’s commitment to end the transport of plastic waste aboard any of its ships as of June 1, 2022. The presence of this “heavy weight” player in global container transport sends a strong signal to the rest of the international maritime services community on the importance of environmental engagement, GME said. Its certification program deals with prioritised environmental issues related to air and water quality, the protection of biodiversity, and waste management, providing a framework for maritime companies to measure their environmental footprint and subsequently reduce it.