Citrus losing primacy in global fruit trade

As the fruit sector diversifies, citrus is coming to play a smaller role. While Spain dominates the citrus trade overall, African and South American countries are coming to play a greater role in certain regions.

Between 1980 and 2016, exported volumes of fresh fruit increased from 23 to 87.5 million tons (+193%). While the growth in total fruit exports (+280%) outstripped growth in production (155%), the opposite is the case when we look at the citrus category, where production increased by 139%, but exports only rose by 133%, from 6.9 to 16 million tons. The shrinking role that citrus has come to play in the global fruit trade is highlighted by the fact that its share of world fruit exports plummeted from 30% in 1980 to 18.5% in 2016.

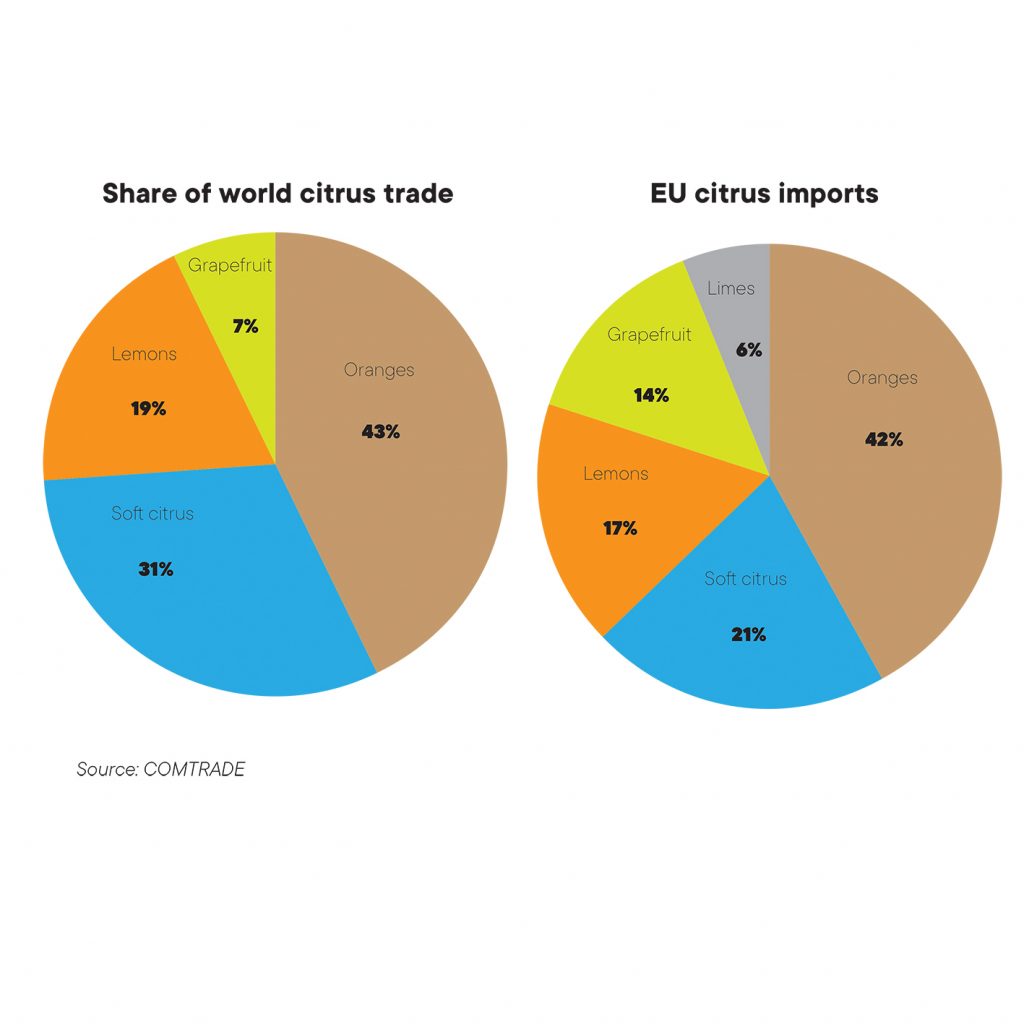

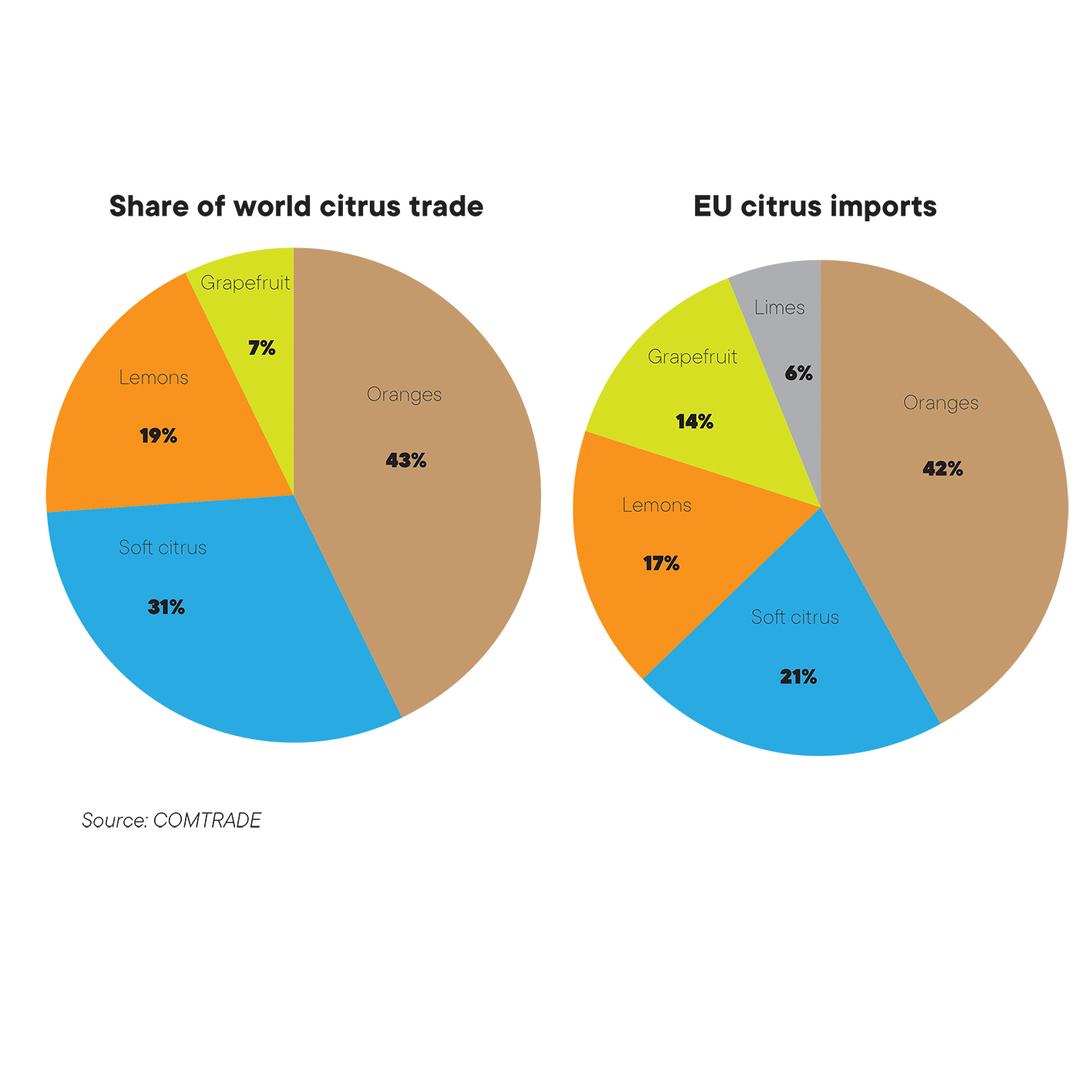

Oranges and grapefruits losing their shine

When we examine the breakdown of the world’s citrus trade, we find that oranges and grapefruits have seen their share drop, while soft citrus and lemons now play a larger role. While in 1980, orange exports accounted for 59% of all citrus exports, by 2016, their share had fallen to 43% (6.8 million tons). Over the same period, exports of grapefruit registered a fall in their category share from 12% to 7% (1.1 million tons in 2016). In contrast, soft fruits almost doubled their share of the category’s exports, rising from 15% to 31% (5 million tons in 2016). Similarly, lemons saw their share of citrus exports rise from 14% to 19% (3.1 million tons in 2016).

Spain dominates citrus export markets

The world’s number-one citrus exporter remains Spain, but the picture has shifted somewhat over recent decades. Spain leads the way in exports of orange and soft citrus, and is second only to Mexico in lemon/lime exports. The Spaniards’ greatest rival is South Africa, with the major Southern Hemisphere player leading the way in grapefruit exports, ranking second in oranges, and fourth in soft citrus and lemon/limes.

Leading orange exporters

In 2017, Spain, with 1.8 million tons, accounted for 27% of the world’s orange exports, well ahead of South Africa in second place, with 17% (1.2 million tons), followed by Egypt, with 10% (660,000 tons), Turkey, with 9% (621,000 tons), and the US, with 8% (570,000 tons), according to COMTRADE data. Spain dominates the world’s soft citrus category, too, accounting for 22% of all exports. Some way behind Spain lies China, in second place, with 10% (494,000 tons), followed by Turkey, with 9% (454,000 tons), South Africa, with 4% (201,000 tons) and Israel, with 2.6% (129,000 tons).

Leading lemon/lime exporters

As for lemons and limes, in 2017, Mexico was the world’s largest exporter, with 24% of the market share (730,000 tons), followed closely behind by Spain (22%), with (690,000 tons), Turkey, with 15% (450,000 tons), and South Africa, with 9.5% (300,000 tons). The grapefruit segment sees South Africa out in front, with 20.5% of global exports (227,000 tons). The other major grapefruit producers are all in the Northern Hemisphere. Close behind South Africa comes China, with 17.5% (192,000 tons), followed some way back by Turkey, with 11.5% (127,000 tons) and the US, with 7.7% (85,000 tons).

The surge of South American citrus

In recent times, South American producers have grown in prominence in the global citrus trade. Peru’s citrus exports have rocketed 380% in the last decade, while Chile’s are up 200%. Meanwhile, Egypt and Pakistan recorded 175% rises, and China and Turkey’s citrus exports have doubled. In volume terms, Turkey has seen the largest rise over the last ten years (+800,000 tons), followed by Spain, Egypt and China (+450,000 tons).

Europeans prefer oranges, Japanese prefer soft citrus

Demand for citrus varies greatly from region to region. The EU has the largest per capita consumption of oranges (8kg per year), while the Japanese consume less than 1kg per year on average, according to Freshfel data. However, in terms of soft citrus, the Russians (5.8kg) and the Japanese (5.2kg) lead the way, while Europeans consume just 4.6kg per capita. The North American consume the most lemons, with Canadians purchasing 2kg and US consumers 1.9kg of the fruit each year. As for grapefruit, Canadians once again lead the way alongside EU consumers (1.04 kg), with Russians consuming just 0.4kg of the fruit each year.

Russia is world’s number-one citrus importer

EU countries import the largest volumes of citrus (including intra-EU trade), accounting for 45% of the world’s imported citrus volumes. However, the single country that imports the largest volumes of citrus is Russia (9.6%). While demand for citrus is growing worldwide, the picture is varied in different regions of the world. If we compare the 2005-07 average total citrus import volumes with the 2015-17 average, we find that the greatest proportionate increases have been recorded in Middle Africa (+1461%), Southern Asia (+372%), and Central Asia (+304%). In volume terms, over this ten-year period, demand for citrus has risen most in the EU (6.5 to 7.2 million tons, +10%), followed by Russia (1.0 to 1.5 million tons, +54%), North America (0.94 to 1.46 million tons, +55%) and Eastern Asia (0.86 to 1.1 million tons, +29%).

Chinese market dominated by soft citrus

As the world’s largest citrus market (34 million tons), it is worth examining trade data for China. The Asia giant produces 34.1 million tons of citrus for the fresh market, of which soft citrus represents 62%, oranges comprise 21%, grapefruits account for 13%, and lemons constitute 4%. China is a net exporter of citrus (933,000 tons shipped abroad in 2017), with the main destination markets being Vietnam (17.6%), Russia (16.4%), Thailand (14.8%), the EU (11.8%) and Malaysia (10.6%). China’s imports of fresh citrus have steadily increased over the past ten years, from 560,000 tons, in 2008, to over 1 million tons in 2016. The main overseas source of citrus for the Chinese market is South Africa (35.9%), followed at some distance by the US (19.7%), Egypt (17.4%) and Australia (14.7%).

EU looks to South Africa for citrus imports

Turning to the EU citrus market, the Europeans consume 11 million tons of citrus. Oranges account for 57% of the total (6.2 million tons), soft citrus represent 28%, lemons constitute 11%, followed by grapefruit (3%), and lime (1%). While citrus imports from outside the EU have fluctuated over the past ten years, largely in line with variations in European crops, they have tended to remain between 2 and 2.4 million tons per year. The major source of non-EU citrus is South Africa (653,000 tons), followed by Egypt (331,000 tons), Argentina (221,000 tons), Morocco (204,000 tons) and Turkey (186,000 tons). The share of non-EU imports represented by lemons (17%), grapefruit (14%) and limes (6%) is greater than their share of intra-EU trade, while the reverse is the case for oranges (42%) and soft citrus (21%).

Russia and the Gulf record rises in citrus imports

Russia’s fresh citrus market consisted of 3.9 million tons of fruit in 2017. The category is divided between oranges (37%), satsumas (30%), lemons (14%), clementines (12%) and grapefruit (7%). The country’s citrus imports climbed steadily between 2004 and 2013 (from 0.82 to 1.68 million tons), before falling off slightly. The major supplier of citrus to the Russian market is Turkey (38%), followed by Egypt (16%), Morocco (15%), South Africa (9%) and China (8%).

Taking the Gulf market as a whole, citrus consumption climbed steadily between 2012 and 2016 (from 1.6 million tons to 1.9 million tons), before dropping off slightly in 2017 (1.68 million tons). The main suppliers of fresh citrus to the Gulf in 2017 were Egypt (525,000 tons), South Africa (430,000 tons), Turkey (120,000 tons), Pakistan (110,000 tons), Lebanon (47,000 tons) and Spain (43,000 tons).