Andalusian citrus prices fall under pressure from Egyptian product

Spain’s agricultural ministry reports a good crop for Andalusia’s 2017/18 citrus campaign, while flowering and fruit set in spring has been acceptable. The first part of the campaign was marked by a lack of calibre in the fruit as a result of a dry summer, which resulted in lower supplies from certain production areas. The second part of the campaign featured storms and intense winds during March in much of Andalusia, resulting in lost production of later varieties, with ripe fruit falling to the ground or being weakened by humidity.

Prices were reasonable and positive for the sector. The first part of the campaign started with high average prices due to the speculation that there would be a possible lack of product in the second part of the campaign. This caused difficulties for the handling centres to commercially place the fruit in the market. During the second part of the campaign, heavy rains paralysed citrus harvesting in the field due to the state of the land and the impossibility of accessing the plantations. Moreover, fruit arrived from other producing countries like Morocco.

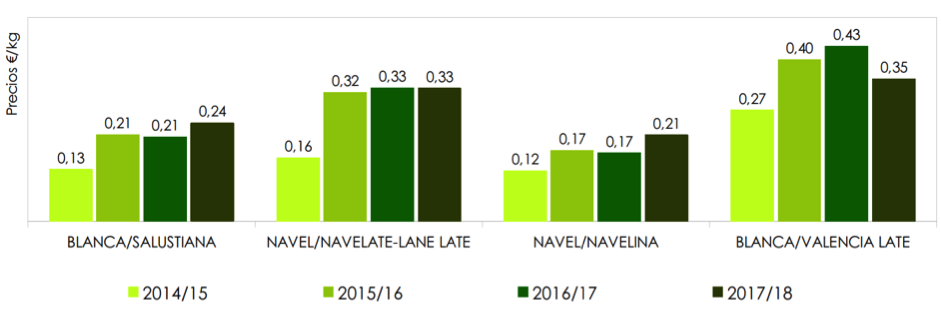

In the specific case of the orange, average prices in the field in the 2017/18 campaign were 11% lower than those registered in the 2016/17 campaign. However, they were 18% higher than those registered in 2015/16 and 26% higher than the average prices recorded in the five-year period between 2013 and 2017. The average value of processed orange increased by 8% from the previous season and was 23% above the five-year average.

The average value of mandarin in 2017/18 fell by 18% from the previous year, and 7% compared to the 2015/16 campaign. However, it is 4% higher than the average price recorded in the last four seasons. The prices of mandarin at the handling plant fell by 8% compared to the 2016/17 season, but they represent an increase of close to 2% with respect to the average of the last four years.

In general, the average value paid to the farmer for the lemon in the 2017/18 season fell by 6% with respect to the previous season, however it is similar to the average price registered in the last four seasons As with the orange, average prices recorded in the marketing of processed and packaged lemon increased by 12% compared to the 2016/17 season.

The campaign has been marked by the entry of fruit from other producing countries with more competitive prices and with improving levels of quality. This is true for citrus from Egypt, South Africa and Morocco. Specifically, there has been a shift from Spanish oranges (and even Moroccan oranges) towards Egyptian oranges in both the EU and Asian markets. The improved quality of Egypt’s fruit is accompanied by the depreciation of the Egyptian pound with respect to the Euro and the dollar, translating into a greater difficulty in the marketing of Andalusian production and a lower growth than expected in Andalusian exports to third countries.

However, there has been growth in recent years of exports of late Andalusian citrus to third countries, such as China, Hong Kong, Malaysia, Australia, Brazil or Canada, where the quality of the Andalusian fruit is a fundamental factor. It is important to highlight that these exports play an important role in reducing citrus supply in the European market during the second part of the campaign.