Global apple crop shrinks in 2018 due to smaller Chinese crop

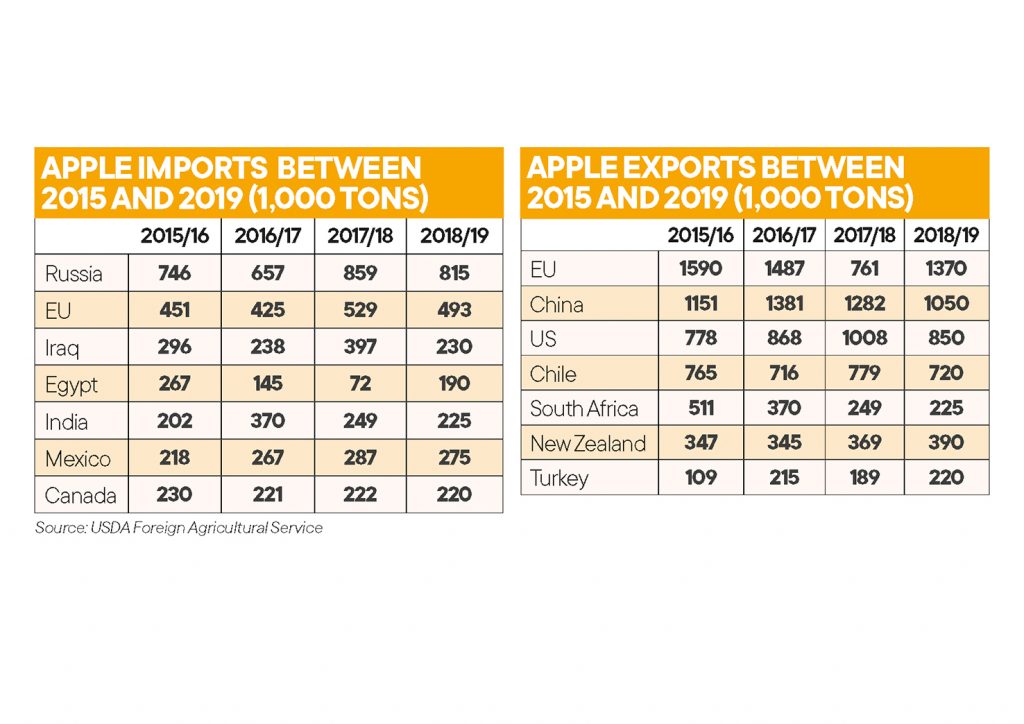

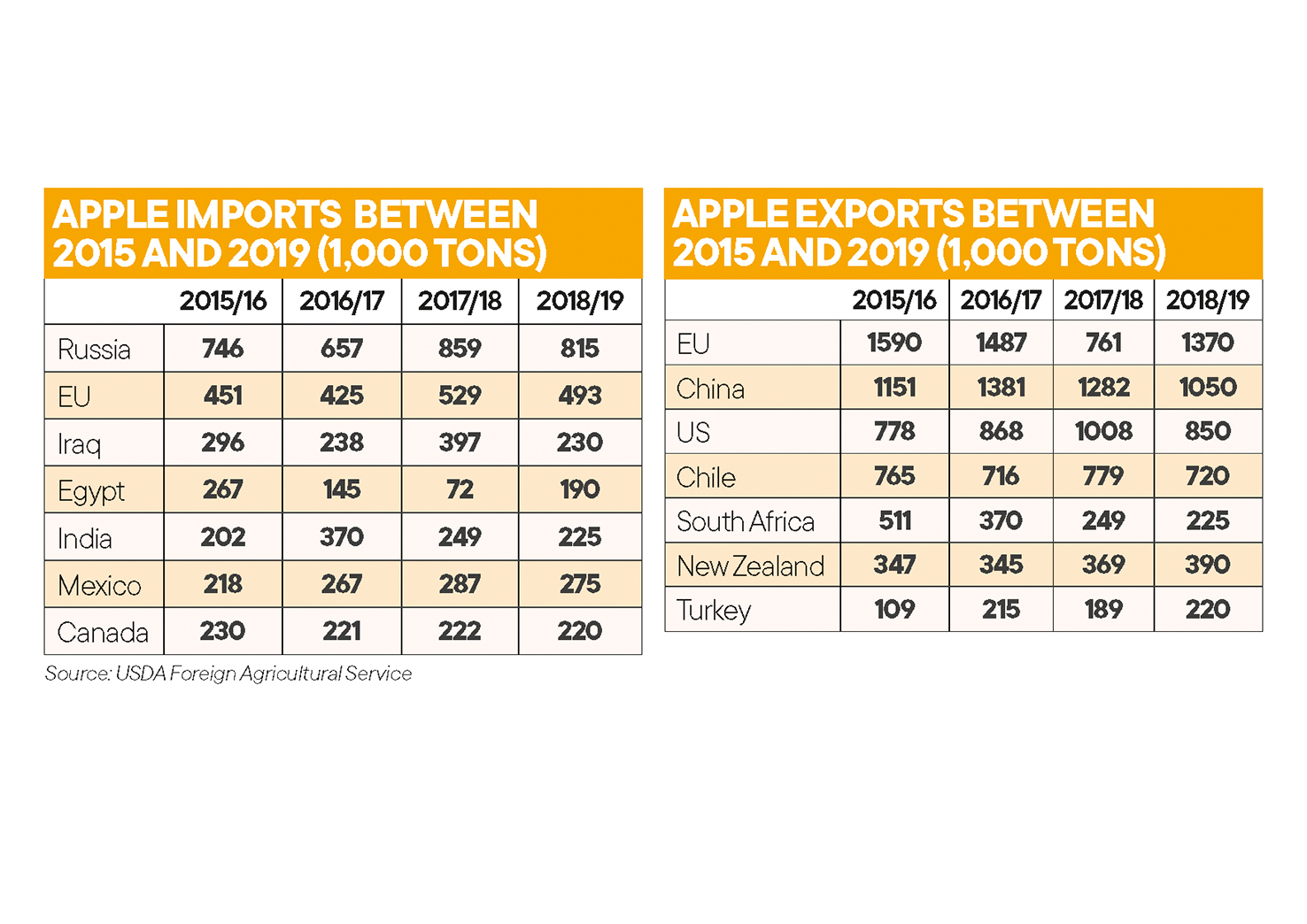

Despite a strong EU fresh crop, global fresh apple production fell 9% to 68.7 million tons in 2018/19 due to weather-related losses in the world’s largest producing country, China, according to USDA data. The lower quality product led to an 8% fall in exported volumes to 5.7 million tons and a rise in volumes for processing, at the expense of apples for consumption. China remains the world’s largest exporter, followed by the US and Italy. Germany is the world’s largest apple importer, followed by Russia and the UK.

With China’s crop shrinking 25% to 31.0 million tons (its lowest level in nine years), exports were down by nearly a third to 880,000 tons. To compensate for the smaller domestic crop, imports rose 19% to 75,000 tons. While the US remains China’s top Northern Hemisphere supplier, the 50-percent retaliatory trade tariff imposed on US apples is opening up opportunities for other sources. Indeed, greater volumes arrived this year from New Zealand and the EU, which more than offset the lower supplies from the US.

In the EU, after a bad 2017/18, the 2018/19 crop was up 40% to 14.0 million tons thanks to increases in production area and productivity. With greater availability, the EU saw a 71% surge in its exports to 1.2 million tons and a fall in imports to 470,000 tons. There was a particularly large jump in shipments to Egypt and India, with the latter currently imposing a ban on Chinese apples for phytosanitary reasons.

US production is expected to fall 0.75% to 5.0 million due to a slightly smaller crop in Washington. Trade disputes are taking their toll on US apple exports, with Mexico and India both imposing retaliatory tariffs. This is expected to have induced a fall of almost 25% in shipments to 760,000 tons. Meanwhile, imports to the US are expected to be up to 160,000 tons due to higher shipments from Southern Hemisphere suppliers New Zealand and Chile.

Turkey’s crop increased 9% to 3.0 million tons due to favourable growing conditions. This should lead to a 26% jump in exports to 240,000, with the Iraqi market becoming an ever more important destination.

India’s apple sector has recovered from a bad 2017/18, with a rise of 21% in its crop size to 2.3 million tons. Despite experiencing a major shift in its sources of imported apples, volumes remained stable at 245,000 tons, with higher shipments from the EU, New Zealand and Chile offsetting the lack of imports from China and lower supplies from the US.

Russia’s apple sector has undergone a major restructuring in recent years thanks to government support for agricultural production. Apple output rose 10% to 1.5 million tons as commercial orchards become more productive. With domestic production rising and lower shipments from China, imports dropped 7.4% to 795,000 tons.

In Chile, unfavourable growing conditions led to a slight shrinkage in the country’s crop size to 1.3 million tons. Lower availability led to a 5% drop in exports to 739,000 tons.

South Africa’s apple production continues its slow recovery from years of drought, with production up 6.3% to 840,000 thanks to better irrigation water and growing conditions. Exports are set to surge 20% to 540,000 tons.

In Mexico, late frosts led to a fall in output for the third consecutive campaign, with volumes down 7% to 660,000 tons. Despite the lower domestic supplies, imports were down to 240,000 tons due to the retaliatory tariff imposed on US apple imports between June 2018 and May 2019.

New Zealand’s production contracted 2.5% to 560,000 tons due to smaller calibre fruit. The country’s apple production area is expanding by around 4% each year. Exports are stable at 370,000 tons, as higher volumes to Vietnam offset smaller deliveries to the EU.