Full attendance at the 4th Morocco Berry Conference

- Produce

- Berries

- Europe

- Morocco

- Portugal

- Russia

- Spain

- The Netherlands

- UAE

- UK

- US

- MOROCCO BERRY CONFERENCE

- berries

- blueberries

- breeding

- BreedingValue

- Multiscan

- pruning

- raspberry

- Seal Label

- strawberries

Morocco’s berries sector faces ever-more serious challenges, such as issues relating to production costs, water and climate. Nevertheless, the country’s exports continue to grow. On November 9th in Agadir, the 4th Morocco Berry Conference gathered once again the leading experts to discuss solutions for Morocco’s growers, packagers and exporters. The conference registered full attendance, with +600 registered delegates. Since the recent inflationary trends, raspberry and strawberry cultivations have started losing their profitability, leading to a decline in production and exports. Blueberries alone continue to be profitable and maintain double-digit growth, according to Amine Bennani, vice-president of the Morocco inter-professional organisation Interpro Berries.

Stable European market for blueberries

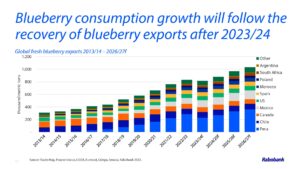

Agrifood expert Cindy van Rijswick from Rabobank highlighted today’s reality and the prospects for the berry markets. While the strawberry market remains stable, she considers the growth potential for other berries is likely to pick up again soon. Since costs and production risks remain high, it is more important than ever to ensure scale, efficiency, the right marketing window and the right varieties to remain competitive. Rabobank analysis of the retail purchases of fresh fruit over the last 5 years in Europe shows a return to the “normal” pre-Covid levels in some countries like Germany. Others, such as France, Italy, Spain and the Netherlands, registered falls of around 10% in 2022 due to inflation, while 2022 retail sales were similar to those of 2019 and 2020. Part of the drop in retail sales has been compensated for by the good recovery of the food service sector, with turnover up in 2022 and 2023. Examining the berry category, European household purchases are very stable at around 24kg of strawberries, 9kg of blueberries, 2.5kg of raspberries and half a kg of blackberries per person per year in the Netherlands. As only blueberries have shown a slight increase, they continue to show clear growth prospects globally, with the potential to reach 1 million tons of fresh blueberry exports worldwide, compared to slightly over 800,000 tons in 2022/2023 and around 300,000 tons 10 years ago. “Morocco’s blueberry exports are set for further growth, with a lengthening window, while Chile has shortened its calendar and Peru also faces climate adversities, with their exports in 2023 dropping for the first time in history by around 20%,” said Cindy.

Morocco sees slowdown in berry exports and a sharp decline in frozen berries

Morocco, which already heads the list of largest exporters of fresh raspberries to the UK, has now also become the top blueberry exporter to the UAE, leaving South Africa behind. Morocco ranks third in the world among exporters of fresh raspberries and fourth among blueberry exporters. Fresh berry exports from Morocco totalled 134,100 tons in 2022/2023, up by 7% Y-o-Y compared to the 18% growth registered in the previous season. Europe represents 94% of shipments, the Gulf countries 3% (2% last year), North America 0.8% (1.1% last season), and Russia 0.8% (0.5% previous season). Frozen berry exports plummeted by 35% to 61,000 tons.

Interpro Berries warns of growing challenges

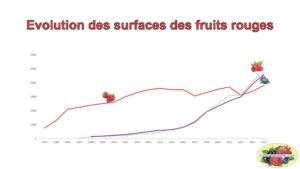

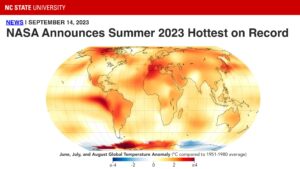

Morocco has about 4,800ha of blueberries, 4,605ha of raspberry plantations and between 3,000 and 3,500ha of strawberries. Strawberry exports declined sharply for the first time, due to the strong competition and inflated costs. According to Interpro Berries VP Amine Bennani, the short seasonality of strawberries is also a handicap compared with raspberries, which are exported almost year around, and blueberries, which are sold between December and June. Morocco’s ambition is to double berry exports to +350,000 tons of fresh and frozen products by 2030, but the growing challenges caused by water scarcity and climate change pose serious threats. For the first time, Agadir experienced summer temperatures of over 50 degrees for several days. Strong winds last October in the north (Loukous Gharb) affected the majority of plastic plantations and delayed harvest by a few weeks. Meanwhile, farmers have largely embraced sustainability by increasing investments in technology and educational programmes. The growing investments made by the world’s largest berry groups also prove the long-term sustainability of the sector. These groups include African Blue, Agrovision, Atlantic Blue, Agro Berries, Berry Gardens, Berry World, Costa, Dira, Driscolls, Fall Creek, Messem, Planasa, Royal, San Lucar, and Surexport.

Afripick’s marketing strategies for Canada and Russia

Founder and CEO of berry startup Sofia Rbei advised Morocco’s growers and exporters on exploring new markets, like Canada, Russia and the UAE, where Morocco’s berries have recently been introduced. Morocco gained market access to Canada in 2021, shipping US$1.3 million worth in 2022. The country represents a US$4.3 billion market for blueberries with a global market share of close to 6%. “Morocco has a window of opportunity between Peruvian and US productions, but work needs to be done to invest in attractive packaging, comply with protocols and build long-term partnerships,” said Sofia. She also highlighted the great market potential offered by Russia, which is increasing its blueberry imports by +50% every year. Russia imported US$90 million of fresh blueberries in 2022, against 2.3 million in 2018. Morocco has a 25% market share and can grow further if it builds a more reliable supply chain and uses appropriate packaging.

Controlling the logistics of the entire supply chain is another strategic area to reduce risks and optimise costs. For this reason, in 2022, Afripick established a Spanish subsidiary in order to self-contract European logistics, reduce trade barriers, trace shipments and have better access to EU markets. “Our final goal is to ensure better returns for our growers,” said Sofia.

Induser delivers worldwide solutions for sustainable packaging

The Almería manufacturer confirms the company’s growing internationalisation, which helped double turnover in 2022. “Clients outside of Spain today represent 60% of our turnover,” said CEO and co-founder Elvis Moreira. The firm has a network of 15 distributors in Europe, Africa (Morocco), the Americas and Asia. Induser supplies about 180 packaging lines per year, mainly for vegetables and berries. While diversifying its portfolio of solutions such as fresh produce and nuts, among its latest innovations are the cold heat-sealing of trays with adhesive labels, and plastic-free “top-bod” closed cardboard trays with a biodegradable window.

Agromillora to add nurseries in Mexico and Peru to its Moroccan ones

The world’s second-largest tree nursery group has 11 nurseries of fruit and olive trees around the globe, and will have 13 production centres in 2024: 3 in the US, 3 in Latin America (Brazil, Chile and a new one being built in Peru to start producing in 2024), 2 in Spain (San Sadorni and Extremadura), one in Morocco, Tunisia, Turkey, Australia and soon in Mexico. The Extremadura nursery is the largest of the group with 10ha of production, for a capacity of 10 to 12 million plants annually. The group sells about 80 million plants around the world each year.

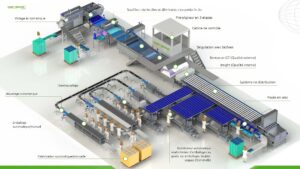

Weco and Multiscan introduce the new “BB20” spin sorter for Blueberries

The new “BB20” sorter for blueberries has been launched by Weco and Multiscan. The new machine has all the attributes to be a game changer on the market. The machine is very attractive in price, stands just 3 metres in size and has 4 exits. It can sort by both size and defect. It is a perfect add-on for the Weco-line to achieve capacities of up to 4 tons per hour. Thanks to its high versatility and efficiency, it allows multiple configurations of its sorting parameters. It is an ideal device for reducing labour and space required for machinery, in addition to avoiding reprocessing.

Weco and Multiscan sell more than 3,000 sorting machines a year for small fruit and nuts around the world. Weco and Multiscan belong to the Duravant group based in Chicago, a holding of more than 15 manufacturing companies in the food processing and packing industry. Multiscan is the world leader in sorting solutions for olives and other small fruits. Based in California, Weco specialises in blueberries, nuts and wine grapes.

Session 2 of the congress: Focus on technical issues for better crop monitoring and performance

Lukas Seehausen from the international organisation CABI enumerated the new pests in the world which can be a threat to berries, such as the new invasive species Scircothrips dorsalis and Halyomorfa halys. Biological control can help as a complementary strategy for farms. Lukas noted the need to invest in more research and a collaborative approach among countries and stakeholders of the industry. CABI is an intergovernmental not-for-profit organisation of 48 member countries that applies scientific expertise to solve problems in agriculture and the environment.

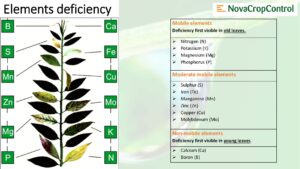

NovaCropControl: Accurate plant care is possible

Established in 2019, NovaCropControl (NCC) uses plant sap from leaves to measure the dissolved salts and give the current situation of a plant’s nutrition that can be used to help it grow. The leaf samples are usually sent to a laboratory based in Wageningen and results given within 24 hours. The analysis measures 21 parameters per sample: EC, pH, sugars, 10 macro-elements and 8 micro-elements. The analysis report also defines target values per type of crop. NCC solutions are being increasingly provided for berries growers around the world wishing to optimise plant nutrition.

Pruning techniques in blueberries offer new approaches to improve yield

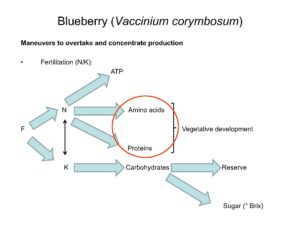

Sebastian Ochoa Münzenmayer, world-renowned blueberry expert, presented the basis for achieving quality fruits through a process of pruning plants at the latitudes of Morocco, a subtropical area, respecting timing, to secure the most interesting harvest calendars. He noted the importance of balancing both root/shoot health to keep an active plant during the summer through irrigation and fertigation management, highlighting the balance between K+/NO3- and NH4+/NO3-. He also introduced a new topic that can impact potential, which is the oxidative stress caused by excessive light and excessive heat. He highlighted the importance of specific amino acids that help regulate the response of plants to these typical stresses that affect plants, particularly after pruning and during summer growth.

Maf Roda: How sorting technology helps reduce costs and improves final product delivery

Spanish commercial director Jaime Medizabal explained the importance, when reaching a certain scale of blueberry production, in an industry that demands uniformity and quality, to know how to select the best sorting line to accelerate the business of modern growers. Mafroda technology features the most recent AI and optical sorters that can make the difference in saving sorting time when we have different qualities.

PSA BDP: Challenges in long-distance logistics

Islam Abdulrazaq, logistics expert of the UAE office of the integrated logistics company PSA BDP, explained the processes in importing fresh produce and the steps that are really important to respect. He highlighted the need for all parties to work together to make sure that the berries reach the shelves with a reasonable shelf-life and quality to meet customer demands.

Blueproject Chile: Trends in post-harvest technology

Paula del Valle, a post-harvest expert from Chile, presented a list of already in-use technologies to ensure the extension of the natural quality of berries, in particular blueberries. Del Valle highlighted that quality starts with the management of the fruit in pre- and post-harvest conditions and that newly added technology, such as sulphur dioxide sheets or vacuum chambers, enable quality preservation and reduce the impact of diseases in long-distance transportation of berries.

Session 3: Breeding & sustainability: The new resilient cultivars

Climate change was obviously on the table at the congress, with Prof Bruno Mezzeti describing the collaborative research that has been done to assess needs and to breed new strawberry varieties for the Mediterranean climate as well as for Moroccan conditions. The focus is on less water use and more pest-resistant and heat-tolerant varieties and genetics, with the presentation showing examples of the work of the “Berry Value Research Group” as well as with local Moroccan research stations.

North Carolina University: The new blueberry breeding paradigm

Hamid Ashrafi, the breeding group leader of North Carolina University, presented his university’s research to support local growers, highlighting the climate change issue as a focus point for their research in the US and internationally. The less chill in the chilling areas and lower water availability are the motors for developing new genotypes that can show more resilience to thrive in this new climate. Prof Ashrafi enumerated some of the new releases of the breeding programme which focuses on mid-chill zones (500-800 chilling hours), as these may be of use in the mountainous areas of Morocco.

INIAV Portugal: Growers and consumers are a driving force behind raspberry breeding

Prof Pedro de Oliveira from INIAV Portugal showcased the latest breeding developments of Portuguese research into raspberry breeding, a programme that started 4 years ago. He explained how the private sector seeks alternative varieties, with the consumer factor leading to more collaboration between private and public institutions, as is now a reality in the Portuguese raspberry industry. Here, he highlighted that Portugal is the world’s number 8 producer of fresh raspberries, meaning that the country has something to say about the new introduction of varieties in the future.